44+ what percent of income should a mortgage be

Ad 5 Best Home Loan Lenders Compared Reviewed. Ad Check How Much Home Loan You Can Afford.

Learning Latent Representations Of Bank Customers With The Variational Autoencoder Sciencedirect

Your monthly payment will be higher with a 15-year term but youll pay off your mortgage in half the time of a 30-year term.

. Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford. Your total monthly inescapable obligations including PITI should be 35 or less of your pre-tax gross. Web This means your monthly payments should be no more than 31 of your pre-tax income and your monthly debts should be less than 43 of your pre-tax income.

Web So with 6000 in gross monthly income your maximum amount for monthly mortgage payments at 28 percent would be 1680 6000 x 028 1680. Compare Lenders And Find Out Which One Suits You Best. Web Ideally home buyers should put at least 20 percent down on their new dwelling but thats simply not possible for many buyers.

The 3545 model says that your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income. Web The 28 percent rule which specifies that no more than 28 percent of your income should be spent on your monthly mortgage payment is a threshold most. Web But there are two other models that can be used.

Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the. It Pays To Compare Offers. Web To follow this rule your monthly mortgage payment should be 28 or less of your gross monthly income.

Web The 3545 model. For example if your monthly income is 5000 you can. Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income.

Check Your Official Eligibility Today. Updated FHA Loan Requirements for 2023. Web There are four common models prospective homebuyers use to calculate the percentage of income they should spend on a monthly mortgage payment.

There is a two-year BTL fixed rate at 532 60 LTV up 009 percentage points with a 999 fee or a two-year fix at. Web Once a potential home buyer has taken the time to examine their personal finances and established how much house they can afford by using the 2836 ratio. Principal interest taxes and insurance collectively known as PITI.

Although the general rule from lenders is that you can afford to spend up to 28. Comparisons Trusted by 55000000. Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and insurance.

Web A mortgage payment is made up of four components. Use Our Tool To Find Out If You Qualify. Ad Check How Much Home Loan You Can Afford.

Use Our Tool To Find Out If You Qualify. Looking For Conventional Home Loan. Web This means that if you want to keep your DTI ratio at 43 you should spend no more than 18 900 of your gross income on your monthly payment.

Ad First Time Home Buyer. When determining what percentage of. Web A 15-year term.

John in the above example makes. Web Buy-to-let rates are also increased. Easily Compare Mortgage Rates and Find a Great Lender.

Find The Right Mortgage For You By Shopping Multiple Lenders. Ad Take the First Step Towards Your Dream Home See If You Qualify. And you should make.

Web Total monthly mortgage payments are typically made up of four components. Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income. On a 400000 property a 20.

Interest principal insurance and taxes. Web As a general rule of thumb your monthly housing payment should not exceed 28 percent of your income before taxes. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance.

Mortgage Broker Cairnlea Caroline Springs Taylors Hill Mortgage Choice

What Is Fannie Mae Purpose Eligibility Limits Programs

First Community Mortgage Avaleht Facebook

Home Loan And Financial Services Experts In Tweed Heads Mortgage Choice

What Is The 28 36 Rule Lexington Law

How Much Of My Income Should Go Towards A Mortgage Payment

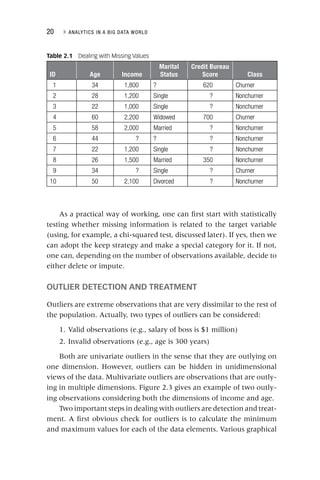

Phan Tich Trong Big Data Pdf

How Much House Can I Afford Insider Tips And Home Affordability Calculator

How Much House Can I Afford Insider Tips And Home Affordability Calculator

What Percentage Of Income Should Go To A Mortgage Bankrate

Child Care Expenses Of America S Families

What Percentage Of Annual Income Should Go To Rent

How Much Of My Income Should Go Towards A Mortgage Payment

44 Expense Sheet Templates In Pdf

What Percentage Of Your Income Should Your Mortgage Be

How Much House Can I Afford Moneyunder30

What Percentage Of Income Should Go To My Mortgage Mares Mortgage